If your payroll provider is offering a deal that sounds too good to be true, then alarm bells should be ringing in your head. And, as the old Christmas cracker joke says, what steps should be taken when we hear alarm bells? Long ones. In the other direction.

So if someone tries to tell you that they can ensure that you end up with 80% or 90% of your wages in your hand at the end of every week, ask them to explain how that’s possible.

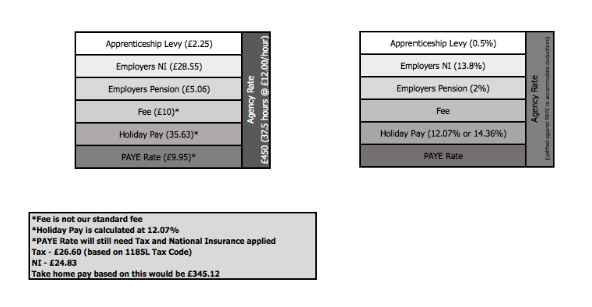

Take a look at our chart [supporting charts below] – it provides a rough estimate of all the things that should be deducted from your pay packet. We’ve based it on someone who has worked 37.5 hours at a rate of £12 an hour, for a total of £450.

As you can see from this table, there are a number of things we have to take into account before we get to the base wages. These include an allocation for holiday pay, Employer’s National Insurance, the Apprenticeship Levy, the employer’s pension contribution and our fee (sorry, but we have to charge you something for doing all the hard work calculating your taxes, NI and all the other things we have to take out – do you really want to do it yourself?).

The £9.95 per hour, which is what is left after these deductions are made, then has to have taxes (PAYE) and employees National Insurance knocked off.

So out of our fictitious friend’s £450, they’re left with £345.12.

We know that there are people who are raising hell about the amount they see taken out of their wage packets, including some unions, but the honest truth is, with the exception of our fee – which we think is very reasonable, given the time, effort and stress we’re saving you – everything we take out we have to, because Her Majesty’s Revenue and Customs or some other government department says so.

Right at the moment, there are some well-known names being taken to court by HMRC over claims for back taxes relating to a range of schemes which the tax authorities claim constitute tax avoidance.

Eamon Holmes, for example, is currently fighting claims which apparently run into the millions, while numerous BBC employees, doctors, nurses, dentists and other small contractors are being threatened with bankruptcy. Many of these cases, but not all, involve allegations of what HMRC is calling ‘fake self-employment’ – usually, where someone is paid through a company they own, rather than by their employer directly.

The contractors then pay corporation tax on the turnover of their company and hand the money out to themselves as shareholders in the company, resulting in a total tax bill of less than half the 45% some of the bigger earners might have been slapped with.

In some cases, contractors never even wanted to be paid in this way – but the firms they are working for insisted, because it also saves them huge amounts in Employer’s National Insurance, pension contributions, sick pay and holiday pay.

But now HMRC is coming for anyone who used a scheme such as this – known as an ‘umbrella company’ – demanding up to seven years’ worth of back taxes in one hit, plus the possibility of interest and fines, depending on the circumstances.

There is another tax avoidance scheme in the headlines, mainly affecting those in healthcare causing severe stress and could bankrupt thousands of hard-working people – the fake loan. This involves people being paid in the form of interest-free loans which they’re never expected to pay back. Again, HMRC is chasing possibly as many as 100,000 people, mainly public sector workers, for a total that has been estimated at £3.2 billion in unpaid taxes.

There is one only one way to make sure you aren’t going to get slapped with a huge bill from the tax authorities: understand what you should be paying and make sure you are paying it.

Anyone who tells you they have a guaranteed way for you to slash the amount of tax and other deductions you pay is either deluding themselves or deluding you. Either way, at the end of the day, you could find yourself having to dig into your pockets to pay an unexpected tax bill which you really should have expected…

And don’t expect the payroll agency you trusted, or the employment agency you worked for, or even the final employer, to save you – because they’re going to be receiving demands for back taxes, plus interest and fines, as well.

That’s assuming they’re still around, and they haven’t quietly transferred their share of the money that should have gone to the Government into untouchable accounts in a nice warm climate…

So, at the risk of repeating myself, when you choose someone to handle payroll matters for you, ask them to show you a breakdown of what gets taken out of your pay every week and why. And if it looks too good to be true, that’s because it is.

If their calculations don’t look like ours, then you only have yourselves to blame if you sign up with them. HMRC has got its sights set on contractors who it claims have been using a variety of ‘tax avoidance’ schemes: what we’ve seen over the past few years has only been the beginning.

By Laura Walsh, General Manager, ePayMe

A version of this article originally appeared in The Educator | January 2019

Photo by Sharon McCutcheon on Unsplash